Coal Seam Gas (CSG) mining and the need for due diligence

August 31st, 2011

For those looking to buy a house in Sydney or an investment property in Sydney, the issue of CSG mining is a further and increasingly high profile example of the regulatory and environmental risks which can be encountered in the Sydney’s ever changing property market.

Nature of the issue

The issue has both public and private elements.

The public element is now well documented and centres around various environmental, health and safety risks associated with CSG mining especially to aquifers supplying water into the food chain and where the “fracking” extraction method is used. Reflecting the seriousness of this topic, that method is now the subject of a NSW State Government moratorium until 31 December 2011.

The private element is of particular interest to existing and prospective property buyers. It centres around the law and other guidelines under which a party becomes entitled to explore for and extract CSG.

Fundamental to that element and a matter of which many of those looking to buy a house in Sydney or an investment property in Sydney are unaware, is that a property owner does not own the natural resources below the surface of the land they are looking to buy.

This reality and the concomitant vulnerability of all landowners (and purchasers from them) to CSG mining is reflected in the three consents that are relevant to the mining and CSG extraction process and which are all technically referred to as “petroleum titles”:

- First, there is the exploration licence which entitles the holder to prospect on the land specified for CSG. Under the relevant legislation (the Petroleum (Onshore) Act 1991), an applicant for such a licence is not required to provide actual notice of the application to landholders or other stakeholders affected by the application. Instead, under the relevant guidelines, such an applicant is only required to publish notice of the application in newspapers. Unsurprisingly therefore, such licences are usually presented to landholders and other stakeholders as a fait accompli the merits of which, under existing law, are not open to challenge.

- Second, the assessment lease which gives the holder the exclusive right to prospect and assess any CSG deposit on the land. Assessment leases can be granted for up to six years and can be extended. Again, the applicant is only required to publish notice of the application in newspapers.

- Whereas CSG miners must have an access arrangement with the landholder before activities can commence under an exploration licence or assessment lease and a refusal to consent can lead to arbitration, according to the Environmental Defender’s Office some practitioners in this area report that determinations at arbitration are usually confined to the conditions to be attached to access arrangements rather than to the question of whether access should be granted at all.

- Third, the production lease which gives the holder the exclusive right to conduct CSG mining under the land. It appears that these do not need to be adverised in newspapers.

No petroleum title can be granted without the written consent of the owner if defined operations are to occur within 200 metres of a principal place of residence (where the occupier’s consent is also required), within 50 metres of a garden, or on land on which there is a “significant improvement”. It is important to note that these restrictions only apply to operations on the surface of and not below the land.

Extent of the issue

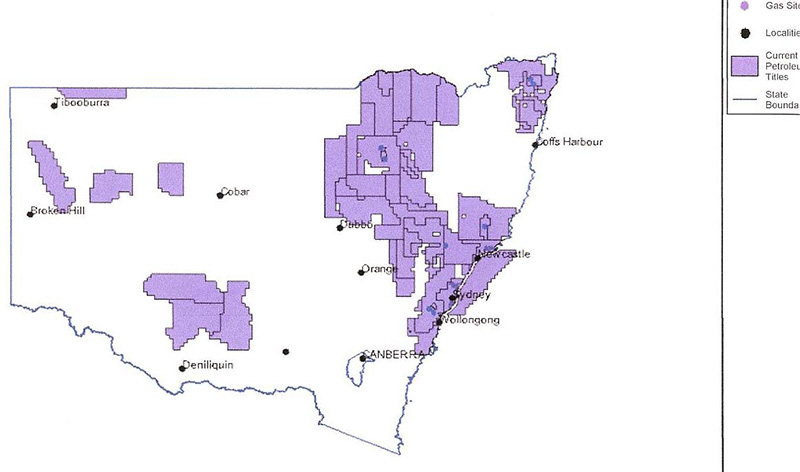

The purple areas shown in the following “Minview” map from the NSW Department of Primary Industries (DPI) shows the geographic areas in which petroleum titles have already been granted and thus, the actual and potential geographic extent of the issue. Plainly, it is not an issue confined to regional areas of New South Wales and as the now widely reported experiences of residents in St Peters and in large sub divisions between Mount Annan and Camden demonstrate, it is a property risk that exists Sydney wide.

Seriousness of the issue

If the mood evident during a public forum attended on 21 August 2011 by Curtis Associates, (buyers agent Sydney), is any guide, CSG mining in the Illawarra and elsewhere in Sydney, is now firmly established as a serious community issue.

What is being done?

In addition to the audit of existing coal seam gas exploration licences mentioned below, the NSW State Government in May 2011 introduced a range of interim measures which are both of limited application and of no comfort or relevance to those looking to buy a house in Sydney or an investment property in Sydney which may be affected by existing petroleum titles.

On 5 August 2011, the NSW Legislative Council announced that as a result of widespread community concerns, a Parliamentary Committee would investigate the environmental, economic and social impacts of coal seam gas mining in NSW.

As well as noting the potential environmental impact of this rapidly growing industry on water supplies, the Committee also specifically noted the issues it raises for property values. (The latter would be consistent with anecdotal evidence from real estate agents operating in CSG mining affected areas of Queensland of lower sales volumes and price falls of around 20%).

The opportunity for the public to make submissions to this investigation close on 7 September 2011.

What are the implications of CSG mining for those looking to buy a house in Sydney or an investment property in Sydney?

It is important to note that once exploration licences have been granted, they ‘run with the land’ and therefore, bind subsequent purchasers. They are also not able to be reviewed or amended retrospectively; a status quo that is likely to remain despite the NSW State Government having announced on 13 July 2011 that it was undertaking an audit of all existing CSG exploration licences.

Further, while development consent from a local council or authority may be required before a petroleum title can be granted, property specific searches of such a council or authority will not reveal petroleum titles over other land on which CSG mining might be conducted and which might have subterranean or other environmental effects on the land being searched.

Whilst it is possible to navigate through a series of steps on the DPI website to download an updated list of petroleum titles and applications, the particular difficulty with this type of property risk is that even if pre purchase due diligence uncovers a petroleum title affecting a property of interest, because of the exploratory element inherent in CSG mining and environmental effects that may be unknown (and in contrast for example, to a development consent for a new building), it is difficult to ascertain the future nature and extent of that risk. In addition, the way in which petroleum titles are identified on the DPI website is not exactly helpful. For example, the petroleum title relevant to the St Peters site is PEL 463 which is described on that website as being “[a]bout 6 km ESE of Hornsby”. Verbal advice from the DPI confirms that this innocuous description is a reference to the northern most point of the relevant “block” and that PEL 463 in fact covers an area of nearly 3000 square kilometres or all of the Sydney metropolitan area.

Although it would appear from the above that all of Sydney is subject to a petroleum title, a reconciliation between the Minview map above and the list of petroleum titles and applications discussed in the preceding paragraph confirms that most of those titles are presently exploration licences rather than assessment or production leases; the latter two of which logically pose the greatest risk as they represent steps closer to actual extraction of CSG.

In this article’s view, an essential reform should be to oblige CSG proponents to provide actual, written notice to all landholders and stakeholders within a wide geographic area of all applications for petroleum titles (especially assessment leases and production leases) with a right being given to those parties to object. Such a regime would be no different to what presently occurs with development applications. In addition, receipt of such a notice should be a matter which vendors are obliged to disclose in all contracts for sale.

This recommendation will be the subject of a submission by Curtis Associates (buyers agents Sydney), to the Parliamentary Committee of the NSW Legislative Council.