Collective strata sales and some tips when buying strata title

September 29th, 2023

In this, our second and last deep dive into some Sydney strata title properties, we discuss collective strata sales before looking at some of the many features both to look for and avoid when buying an existing strata title property.

Collective strata sales

Background

Prior to November 2016 in NSW, a collective sale by owners of a strata building to, for example, a developer required the unanimous approval of those owners.

On 30 November 2016, Part 10 of the Strata Schemes Development Act 2015 (NSW) (SSD Act) came into force.

At the heart of the intricate and time consuming procedure introduced by the SSD Act was a reduction of the approval threshold from 100% to 75% and a provision empowering the Land and Environment Court to force the dissenting owners – the ‘hold outs’ – to sell to such a developer according to complex compensation principles similar to those applying when government resumes privately owned property.

Sugar coated as ‘strata renewal’, the superficially attractive intention of this reform in the residential sector was to make it easier to re-purpose ageing buildings and increase urban densities whilst reducing urban sprawl in response to population growth.

Despite that lofty intention and in a glaring omission, the SSD Act contains no requirement for the developed properties to be replaced by properties with increased density.

Opposition to the idea focused on two aspects: first, on the compulsory acquisition aspect with some owner occupiers warning of enforced homelessness and investors bleating about enforced capital gains tax. The notion that a private citizen has the right, usually enjoyed by governments, compulsorily to acquire your property for a price you didn’t control was understandable anathema (despite an analogous provision in company takeover law having existed for decades).

The second aspect involved how to value the units held by the ‘hold outs’ to the collective sale. For example, if the value of the whole building was greater than the sum of its parts, how were those owners to be compensated? Should they share in any post re-development premium?

In an article in The Conversation on 25 November 2015 entitled “When developers come knocking: why strata law shake-up won’t deliver cheaper housing” four academics from UNSW Sydney wrote:

“The NSW government hopes that this change will increase the number of homes in popular parts of the city and allow older, run-down properties to be rebuilt…

However, new research…shows that while this may increase the rate of redevelopment of older blocks, on their own these changes may not improve housing affordability or availability.

In [the City Futures Research Centre, UNSW Final Report launched today [entitled] “Renewing the Compact City: Economically viable and socially sustainable approaches to urban redevelopment”] we anticipate that this change will:

- …[d]epending on the location, increase either gentrification…Low-rise blocks in expensive areas (around Sydney harbour, North Shore and Eastern Suburbs) are likely to be replaced with boutique higher value blocks, but not necessarily at higher density…

- [c]reate no significant improvement to affordability of rental and home ownership in Sydney. Old apartment buildings that might be knocked down and rebuilt often provide more affordable housing options. However, our research shows that very few blocks could be developed profitably by private developers into housing that’s affordable to people already living in the local area”…(the article).

Experience so far – unintended consequences, popularity but failed objectives

An unintended target, the reforms were quickly embraced in the Sydney CBD office sector where such consolidations between neighbouring commercial strata buildings often allowed for massively increased height and FSR limits; one of the first and with which we were involved as Sydney buyers’ agents being in 2018 at 23 Hunter Street/109 Pitt Street, Sydney.

In the targeted residential sector and as you will see, the highly detailed UNSW Final Report referenced in the article was prescient.

As well publicised, much of the recent flurry of residential activity under the SSD Act has been in Potts Point and Elizabeth Bay (postcode 2011) which we use as a case study summarised in this table:

Address | Existing number of apartments | Existing mix | Proposed number of apartments | Proposed mix | Net loss of apartments | % net loss | Current Approval Status |

11A and 13A Wylde Street, Potts Point | 20 | 11A Wylde 8 Lots 13A Wylde 5 x 1 BR 7 x studios | 5 | 5 x 3 BR Rooftop terrace and swimming pool | 15 | 75 | Being assessed |

1 Onslow Place, Elizabeth Bay | 12 | 12 x 1 BR + parking | 6 | 1 x 4 BR | 6 | 50 | Negotiated settlement approved 29/8/23 by L&E Court |

21c Billyard Avenue and 10 Onslow Avenue, Elizabeth Bay | 28 | 48 bedrooms | 22 | 1 x 4 BR Rooftop terrace and swimming pool | 6 | 21 | Being assessed |

45 – 53 Macleay Street, Potts Point (The Chimes) | 80 | 80 x studios + parking | 28 residential | 19 x 3 BR 4 motorcycle spaces | 52 | 65 | Deemed refusal. On site conciliation meeting occurred on 28/9/23 which we attended |

30A – 34 Brougham Street, Potts Point | 16 | Unknown | 13 | 4 x 3 BR | 3 | 19 | Negotiated settlement approved 9/6/23 by L&E Court |

It is understood that 51 Bayswater Road, Rushcutters Bay is the latest to be acquired which could be a precursor to a very large consolidated site with three or four southern and eastern neighbours.

Since the SSD Act came into force nearly seven years ago:

- there still has only been a handful of collective residential sales State wide and perhaps not many more than the 1.1% of NSW strata schemes terminated as at 2016

- only six of the seven properties in the table are in fact strata title: 13A Wylde Street is company title with that developer proposing to devote seven basement levels to six parking spaces. You have to wonder how many of the existing low cost occupants will be displaced to make way for those six cars if that DA is approved

- the SSD Act been judicially considered in two procedural matters and in just one mostly inconsequential final decision (Application by the Owners – Strata Plan 61299 [2019] NSWLEC 111)

- its compensation regime has never been tested or applied. Whilst that could change with the dozen hold outs in The Chimes, it’s unlikely given the stratospheric prices the developer has already paid or has options to pay for most units and car spaces in that building. Perhaps benefitting from James Packer’s influence, as the Daily Telegraph’s Jonathan Chancellor wrote on 21 July 2023, prices paid for a studio have been as high as $2.063 million. The most extreme example in 1 Onslow Place was the tiny Unit 9 which our research confirms was bought on 25 July 2014 for $351,000 and sold to the developer on 9 November 2022 for $1.475 million – a 322% capital gain in a little over eight years

- with a stated aim of increasing residential density, ironically it has been most popular in Australia’s second most densely populated postcode.

Why?

It’s all about the blue chip location and the panoramic views each of those seven properties enjoy and replicates the experience of the few commercial properties re-purposed into luxury residential apartments as discussed in our July 2023 Newsletter.

And it’s the same reason a major airspace project is now underway to add extra luxury accommodation to the top of an ordinary looking 40 Macleay Street, Potts Point:

Relevantly:

- none of the proposed developments include affordable housing

- the only two Court approved developments in that postcode actually reduced density by 50% and 19% respectively.

On this case study, while embraced by developers (‘getting 75% is a lot easier than 100%’), as an instrument of public policy intended to improve affordability of rental and home ownership in Sydney, the SSD Act has so far been a lamentable planning failure.

A failure that doesn’t fit the State Government’s narrative

As the SMH reported on 27 September 2023:

…“NSW needs to construct 78,000 new homes each year for five years – twice as many as the state is forecast to deliver, and more than has ever been built – just to meet the federal government’s housing target of 378,000 new homes”.

In an address to a NSW Property Council lunch on 26 September 2023, Premier Minns rightly described at least some of the consequences of not doing so in these words:

“Traditionally, we’ve had interstate migration, but it’s often been people who have retired … Now our best and brightest young people that we want to invest…grow… start businesses… and get into the property market in NSW are leaving in unprecedented ways, and it’s not sustainable…The politics of this is changing rapidly in favour of more density”…

Instead of outlining changes to the SSD Act to remedy its failure to date to achieve that very objective, Premier Minns declared war on NIMBY Councils and threatened to use existing State powers against them.

This stance is disingenuous when tested against the current positions of three of the most populous Sydney Councils. The City of Sydney and Woollahra Council in fact recently voted to investigate planning laws resulting in a net loss of dwellings and Waverley Council last year amended its planning laws to require DAs to “increase or preserve residential dwelling density.”

That Mr Minns ignored the failures of the SSD Act, tried to shift the blame on to councils and refused to specify the existing State powers to which he was referring, all suggest his government is as bereft of solutions to these pressing problems as its predecessors.

So, why did we say last month the SSD Act might see a shift in our bias against buying off the plan (OFT)?

For two reasons: scarcity value and the Building Commissioner.

As to the first, for prestige buyers, properties such as those proposed in the above case study would:

- be in established blue chip locations close to water, parks, gardens, galleries and the CBD

- have never to be built out views whether of Sydney harbour, the Opera House, Bridge, Sydney skyline or Elizabeth Bay

- in contrast to the large number of large and prestige, high rise apartments already in and about to hit Sydney’s northern CBD market, under construction in central Sydney and proposed at the southern end of Hyde Park, the properties in our case study are all in low rise, small blocks. If the SSD Act is amended or repealed in the Premier’s quest to solve the so-called housing crisis, those properties will be scarcer still.

As to the second reason, the Building Commissioner might ensure such new developments were free of defects like those which for several years plagued the prestigious 1 Grantham Street next door but one to 11A Wylde Street after it was built in 2010.

Why the SSD Act might not see a shift in our bias against buying OFT

These apartments may become shrines to the excesses of the Baby Boomer generation

Such properties are designed and built mostly for aging, so called ‘rightsizing’ baby boomers who day to day will likely use very little of the vast apartments they occupy.

They may be popular now but who will buy them in the future? While some might be inherited, how many beneficiaries would want to live with their sibling(s)?

As John Kehoe discussed in the AFR on 25 August 2923:

“Australia is sleepwalking towards what former Treasury secretary Ken Henry describes as an unfolding “intergenerational tragedy.”

The nation will become older, more indebted, spend big on social services, grow slower, have weaker income growth and tax working-age people more over coming decades, according to the Treasury’s Intergenerational Report released this week.

After almost 20 years of policy paralysis under Coalition and Labor governments, unless the malaise is turned around, and soon, by federal, state and business leaders, the rapid improvement in living standards enjoyed by past generations will continue to slow.

“The risk is, of course, that future generations of Australians will be denied the opportunity to be as well-off as we are,” said Henry, who worries about the impact of climate change and an unfair tax system on younger people.

“This must be the first time in human history… [we can] even consider it conceivable that a future generation could be worse off than we are.”

Australia’s population will continue to age over the next 40 years. The number of Australians aged 65 and over will more than double and the number aged 85 and over will more than triple, requiring a care and support workforce potentially double the size.

Government spending will increase by a massive 3.8 percentage points of GDP, or almost $100 billion a year in today’s dollars, driven by the fastest-growing areas of health, aged care, the National Disability Insurance Scheme, interest on government debt, and defence.

…. The burden will increasingly fall on a narrower base of working-age taxpayers as Baby Boomers retire, and live longer. Personal income tax is projected to soar from an already record 50.5 per cent of federal tax receipts in 2022-23 to 58.4 per cent in 2062-63.”

We use too much space

If this housing affordability crisis is to be solved making it possible for younger generations to enter the property market, Sydney siders will need to change the ‘quarter acre block’ mentality which underlies these large apartments.

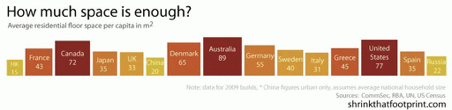

It won’t be easy. As this graphic shows, it’s a tradition deeply ingrained in our DNA and distinguishes Australia from most, if not all developed nations:

Such large scale living is unnecessary for comfort, functionality and amenity.

There is emerging in Australia a trend from architects to create functional yet livable apartments with smaller footprints. These apartments allow their owners a level of luxury living in an area previously considered too small to be comfortable.

For an example at the other end of the scale spectrum, one such architect, multi-award winner Brad Swartz, designed Crescent Apartment in McMahon’s Point as a one-bedroom apartment which is easily converted to contain a guest room created using a murphy bed, a curved wall and bi fold doors.

A wall bed and bi fold doors create a second living space (Image: Tom Ferguson)

Without the wall bed the space is used for dining (Image: Tom Ferguson)

Living smarter, not larger, also makes economic sense: strata title values are calculated in horizontal rates/m2. Space in the vertical plane is often overlooked. Most cabinetry in an apartment with regulation 2.7 m ceilings does not go to the ceiling which would be free. At circa $30,000 – $65,000 /m2 for a luxury apartments in postcode 2011, that equates to $90,000 – $195,000 just to accommodate for example, a horizontal 3m long kitchen cabinet.

Loss of local appeal through ‘blandification’

We discussed this topic in detail almost six years ago and again used postcode 2011 as a case study:

Gentrification: what it means for Sydney property buyers

The observations we made have proven correct.

As a suburb becomes the exclusive domain of the wealthy, it loses the diversity and vibrancy which attracted such people to that suburb in the first place.

In the past six years, the contrast between postcode 2011 and ‘less gentrified/better vibe’ Darlinghurst, Surry Hills, Redfern, Newtown, Enmore and Marrickville is palpable.

Permitting net losses of affordable accommodation for vanity projects of the aged will inevitably accelerate that process. Anecdotally, the absence of affordable housing in postcode 2011 has contributed to staff shortages and in turn, to a raft of recent restaurant closures.

Now, to lighten the tone…

Some top tips for buying an apartment:

As Sydney buyers’ agents who regularly inspect and buy strata title apartments for our clients, there are several criteria we use to determine if an apartment is suitable for their needs.

Our check list is thorough and long.

Here we share some of the items we’ve included over our 17 years and which might not occur to you when buying such an apartment:

- Ceiling heights – the higher and the more volume in the space, the larger the apartment will feel

- Outdoor area – adds to the amenity even if not regularly used because of traffic noise or wind sheer and is valuable on re-sale

- Car parking – side by side is better than tandem

- EV charging – existing or proposed

- Hot water – how is it heated and what is the pressure

- If the view is a feature, see what it’s like from the seated position in the main living area

- Construction method – concrete floors are generally better than timber joists for thermal and sound insulation

- Avoid:

– apartments with more than 30 steps to the front door

– long corridors and toilets or bedrooms leading directly off main living areas

– split level apartments with steps to the main living area from the front door – window treatments can be problematic in split level apartments which can also be expensive to heat and cool especially if not north or east facing

– roof top terraces – the lack of direct connectivity and exclusivity compared to a balcony explains why these expensive items of common property are seldom used

– mechanical car hoists and stackers – if they fail, you can be stranded and some stackers cannot accommodate SUV’s

– car parking with pylons or services that restrict turning circle or obstruct your doors or restrict roof height

– top floor units in flat roof 1960’s and 1970’s buildings – they can be heat traps

– Electric 2 phase instant water heaters – they don’t work

– blocks undergoing strata re-subdivision – it will almost certainly trigger an expensive and time consuming Council Fire Order

– under capitalised buildings or ones with low strata levies – attractive for present cash flow but only deferring the inevitable large, future special levies.

Conclusion

We hope you have enjoyed this two part series.

If you need help navigating the risks and opportunities associated with strata title properties, we look forward to hearing from you.