Special Report ‘Chinese’ buyers of Australian residential property – what’s the truth?

April 30th, 2014 You have to look hard to find a media beat up like this one in recent years.

You have to look hard to find a media beat up like this one in recent years.

Everyone it seems, from eminent journals to an independent think tank have somehow caught the same bug infecting less credible mainstream commentary of which examples are discussed later in this article.

Regrettably, most such commentary has had scant regard either to the facts or the applicable foreign investment regulations.

The Economist this week weighed into the arena with an article in the 26 April 2014 edition entitled “Migrants in Australia – The promised land – Chinese immigrants are re making entire suburbs of Australia’s largest city” .

Unusually for that mast head, that article seems to go nowhere in its discussion of suburbs which, for many years and not just the last two, have had high concentrations of people from Chinese backgrounds such as Hurstville and Chatswood.

The following paragraph appears to justify the publication of the article at this time:

“But China’s emergence as Australia’s biggest trading partner, and its largest source of foreign university students, has revolutionised the relationship. In the fiscal year 2011-12, more than 25,000 Chinese people obtained permanent residence in Australia. Most of them were from the new middle classes. Then in late 2012 Australia launched a “significant investor” visa, aimed at China’s super-rich. To get one, people need A$5m ($4.6m) to sink in “qualifying” investments. After investing for four years, successful applicants can apply for permanent residence…More than 90% of 702 applicants so far have been Chinese”.

Really?

Taking some of the above points in order, whilst it is true that in the 12 months to 31 December 2013, Department of Immigration figures show that China was the largest source of foreign university students, the same figures also reveal that the rate at which student visas to Chinese students grew in those 12 months (6.8%) was by far the lowest of the top seven countries being dwarfed by Nepal (52.1%); Vietnam (38.2%); India (25.8%) and Brazil (19.6%).

As to permanent residents, China in fact ranked behind India in the 12 months to 31 December 2013.

In relation to the significant investor visa, the paltry 702 applications (not approvals) in over two years speaks for itself even before the point made below that such visas do not authorise direct investment in residential real estate.

Nothing too ‘revolutionising’ about any of those numbers.

Often the evidence is distorted to suit the writer’s particular angle or interests.

Take this one for example by Robert Simeon, a real estate agent and Mosman based blogger who wrote a piece published in the 10 March 2014 edition of Property Observer entitled:

“The end of the great Chinese property splurge”

Mr Simeon opined:

“The latest figures from the Foreign Investment Review Board (FIRB) reveal overseas buyers purchased a record 5,091 established homes worth $5.4 billion last financial year, compared with 647 properties to a value of $810 million in 2009-10”.

2009 – 2010 was no doubt selected because of the vast differences between those figures relative to 2013 – 2013.

The later figures reproduce those in Table 2.8 of FIRB’s 2013 Annual Report.

Presumably because it did not fit his narrative, the author omitted this warning endorsed at the start and finish of that table and repeated no less than seven other times throughout the 67 page Report:

“The significant differences in recent years in these numbers were largely due to changes to the screening arrangements for temporary residents purchasing residential real estate in 2010”.

Or this one in the 5 March 2014 SMH by Max Mason entitled: “Locals priced out by $24 billion Chinese property splurge”.

That piece contains this pearl of wisdom:

“The four measurable routes to the so-called “Quarter Acre Dream” are …a Chinese citizen with temporary residential needs buys a house through the Significant Investor Visa [SIV] scheme ($5 million and higher)”…

The grit in the pearl is that under such a Visa, direct real estate investment is non complying.

A particularly low water mark was reached on 18 Feb 2014 with a piece in Guardian Australia by Clive Hamilton with its original and breathtakingly xenophobic title: “Wealthy Chinese buyers are making Sydney’s housing problem worse”.

That article produced an editorial mea culpa so extraordinary in length and detail we must reproduce parts of it but which did not stop the piece being taken up in the same period by SMH’s Paul Sheehan:

Editor’s note, 25 February 2014: This article generated strong response when published on 18 February 2014, including concern about racist undertones in its original headline “Wealthy Chinese buyers are making Sydney’s housing problem worse”.

The author and Guardian Australia disclaim any racist intent. ..

However, Guardian Australia accepts that where a reasonable person could infer racism in an adverse reference to any national or ethnic group. Guardian Australia must be especially vigilant to ensure that the evidence underpinning such content is solid. We have concluded that in this instance we were not vigilant enough. With assistance from our engaged readership, we have found that evidence originally cited in this article was not solid enough to support the original headline, which is now amended.

The author acknowledges that he erred in his reporting of Foreign Investment Review Board data. The secondary source on which he relied conflated figures for residential and commercial investment and overstated the increase in investment from China in 2011-12. This has been corrected. The author stands by his basic thesis, which refers to investment over the last two or so years, though he recognises there is as yet no public FIRB data to support it.

Two pieces of anecdotal evidence from real estate agents also appeared to support the original headline, but on closer examination they are not strong enough to do so. The author was not at fault; in the editing process, Guardian Australia itself did not draw sufficiently precise distinctions between references to Asian buyers in the housing market and those who are ethnically Chinese. Nor did we distinguish properly between ethnically Chinese buyers from abroad and those ethnically Chinese buyers who are local and may, of course, be several-generations Australian. The amended article paraphrases more precisely what the estate agents were reported by other media to have observed.”

This is much like the Knight in that ancient Monty Python sketch who vows to maintain a limbless rage by bleeding on his foe.

Having raised the topic in the first place, more helpful than the editor’s attempt to defend the indefensible, would have been an attempt to investigate the truth about so called Chinese buyers of Australian residential property.

Then there is the contribution made last month by the lofty sounding “strategic alliance” between KPMG and The University of Sydney China Studies Centre bearing the promising title: “Demystifying Chinese Investment in Australia – March 2014 update”.

Relevantly, the latest update opines that “[t]he impact of Chinese investment on residential real estate investment is already being felt in Australia’s capital cities. Recent FIRB reports show that Chinese investors were the largest buyers of residential and commercial real estate in 2012-2013”. Disappointingly, the footnoted authority for the last proposition was not a piece of original research, but the FIRB Reports quoted in the 4 March 2014 edition of The Australian Financial Review; such reliance on secondary sources being consistent with footnote 7 to the same update “[o]ur figures include commercial but not residential real estate.”

Analysis

So, amidst all this de mystified mystery, where do you go to find out the truth?

FIRB is the most reliable source of information and can be supplemented to some extent by searching data maintained by the Department of Foreign Affairs, the ABS and Reserve Bank of Australia. That said and consistent with this article’s long since publicised gripes about data collection in real estate, although imperfect, it is simply the best data available.

FIRB is the statutory body responsible for advising the Federal Treasurer on foreign investment policy with a reporting year that runs from 1 July to 30 June and whose expressed overarching mandate in this regard is to encourage foreign investment that increases the supply of housing stock.

Before going any further, let’s also define five more terms:

In this article:

- “Chinese” means natural and other persons from China (excluding the Special Administrative Regions [currently, Hong Kong and Macau] as well as Taiwan) who are not ordinarily residents of Australia (essentially the same definition given to such investors by FIRB)

- As per the ABS definition, when referring to data from that source “residential” means an ordinary detached house; house with office; house with flat; rural residential houses (within a capital city and not part of a farming business); semi-detached, row and terrace houses; townhouses; flats, units and apartments

- As per the FIRB definition, when referring to data from that source, “residential” means all land and housing that is not commercial property or rural land. (Except in the case of vacant residential land, each of the last two definitions appears in practical terms to be substantially identical to the other)

- Consistent with the convention in Australia:

- “billion” is one thousand million and

- “trillion” is one million million.

In such an analysis, the first question has to be: ‘how big is the Australian residential property market?’

Without knowing that, it is impossible to assess the relative contribution being made to that market by so called Chinese buyers.

According to statistics first compiled by the Australian Bureau of Statistics (ABS) in December 2013, as at the December 2013 quarter there were 9.3 million residential properties in Australia totalling $5.02 trillion in value (Tables 4/5 of ABS Publication 6416.0).

What does an analysis of FIRB’s data tell us?

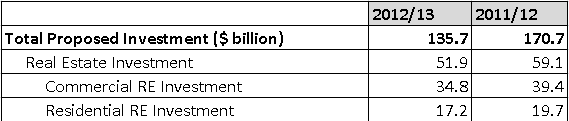

- Despite all the hype, the value of proposed foreign investment in real estate relative to 2012, in fact fell by 12.2 % in 2013:

- Suggesting that some developers of Sydney’s potential inner city cookie cutter slums of the future may have more reason to sell some of their businesses than crow about them, most of that 12.2% downward drag was caused by a 29% reduction in the number and a massive 89% reduction in value of FIRB approvals for new residential properties where the developer has already obtained FIRB approval

- Arresting but not reversing that trend were these two sectors which moved in the opposite direction between the two years:;

- existing residential properties where approvals rose 29% in number and 89% in value and

- new individual purchases (as opposed to off the plan developer approved) where approvals rose 12% in number and 15% in value

As it is relevant to the analysis below, we have also included the following data relating to commercial real estate:

Both of those sectors, especially the purchase of existing residential properties (mostly made by temporary residents), have higher visibility which hints at the reason for the hype.

The truth

Given the above, is it right to single out Chinese buyers?

Even allowing for the fact that FIRB’S most recent data is now 10 months old, the answer on this evidence has to be “no”.

The only data published by FIRB that identifies separate ethnicities appears in Table 2.11 of FIRB’s 2013 Annual Report.

According to that Table, Chinese real estate investment accounted for $5.932 billion.

Interestingly, despite its dominance over China in the student visa and permanent resident stakes, Indian investors do not even rate a mention in that Table.

Here is the same real estate data presented graphically:

Unhelpfully, Table 2.11 does not distinguish between Chinese buyers of residential real estate and commercial real estate.

If you impute to all Chinese buyers the 66%/34% breakdown generally evident in Tables 2.8 and 2.9 of the FIRB report to the total $5.932 billion Chinese spent in the year ending 30 June 2013, it produces a $3.97 billion spend on commercial property and a $1.96 billion spend on residential property:

Whilst ABS does not separately collate what percentage of the $5.02 trillion turns over per annum, an idea can be deduced from Table 4/5 of Publication 6416.0.

On that basis, of the 9.3 million Australian residential dwellings, 510,907 traded between June 2012 and June 2013.

That equates to an annual turnover of 5.5%.

If the number of dwellings traded per annum is any guide to the value of those dwellings (also not separately presented by ABS), then monetary turnover is circa $5 trillion x 5.5% which equates to $275 billion.

$1.96 billion worth of Chinese investment in residential real estate as a percentage of this deduced $275 billion in total turnover equates to a mere 0.71% which, on any view, is a drop in the ocean.

Furthermore and as FIRB itself acknowledges, its figures are likely to overstate actual off the plan purchases and of course, such data also excludes illicit or unauthorised purchases which, if experience as a buyers’ agent is any guide anecdotally, would appear to be of low frequency.

Conclusion:

The Devil, as often the case, is in the detail.

The reason for singling out Chinese buyers obviously derives from China’s sheer size as well as its undoubted status as Australia’s major trading partner and the FIRB statistic that with 11% of the total, such buyers were the largest foreign buyers of Australian residential and commercial property in 2012-2013.

The significant increase since 2011-2012 in buyers of existing residential property presumably via applications for FIRB approval from temporary residents, may also have contributed to the perception. However, there is no public evidence of the extent to which such temporary residents were Chinese.

Similarly, on the only publicly available data relating to ethnicity of foreign real estate investors, Chinese investment in 2012 – 2013 increased by 44% which was paltry compared to the 100% and 101% increases recorded over the same period by Canada and South Korea respectively.

And yet, neither of those two countries is the subject of any media hype let alone the several xenophobic articles recently written on the topic.

The reasons for the apparent ambivalence between seeing, on the one hand, Chinese mineral buyers as white knights propping up the economy and on the other hand, Chinese real estate buyers as scapegoats responsible for aggravating an undoubted housing affordability problem raises policy issues beyond the scope of this article.

Perhaps those issues might be addressed by the House Standing Committee on Economics Inquiry into foreign investment in Australian residential real estate announced by the Federal Treasurer on 19 March 2014.

With submissions closing on 9 May 2014 and a final Report due on 10 October 2014, that Inquiry has these wide terms of reference:

- “the economic benefits of foreign investment in residential property; \

- whether such foreign investment is directly increasing the supply of new housing and bringing benefits to the local building industry and its suppliers;

- how Australia’s foreign investment framework compares with international experience; and

- whether the administration of Australia’s foreign investment policy relating to residential property can be enhanced.”