“…You can stick your little pins in that Voodoo doll. I’m very sorry baby, doesn’t look like me at all”.

September 8th, 2022

“…You can stick your little pins in that Voodoo doll. I’m very sorry baby, doesn’t look like me at all” (Leonard Cohen).

For why those words are relevant to mainstream commentary about the Sydney property market in August 2022, read on:

The month went by:

After the fourth rise in the official cash rate on 2 August 2022 to 1.85%, the rest of the month was relatively quiet as buyers and sellers began adjusting to the new interest rate environment.

Except for the top-end and otherwise attractive properties for which demand remained strong, many stayed on the sidelines leaving bearish commentators little choice but to hibernate.

On 1 September 2022 CoreLogic published it’s August 2022 National Home Value Index for August 2022 (the Index).

Its tagline that the Index had recorded its “largest month-on-month decline since 1983” brought the bears screaming from the caves, tripping over hyperboles in their haste to proclaim that Armageddon had at last arrived.

One of the most strident was Christopher Joye, a contributor to the AFR and Livewire whose 1 September 2022 article on the Index was perhaps the most widely adopted (the article).

Also read: Interest rate rises and the Sydney residential property market – don’t drink the Kool-Aid

As this comparative table of quotations shows, the only problem was that the article’s rhetoric didn’t align with the Index in almost every material respect.

| The article 1 September 2022 | CoreLogic National Home Value Index 1 September 2022 | |

| 1 | “CoreLogic has just released their official housing data for…August 2022, which confirms what we feared… the great Aussie housing crash is only going to get a lot worse…The individual capital city losses in August have been breathtaking”…

| “The annual trend in housing values is rapidly levelling out. After moving through a peak annual growth rate of 21.3% in November last year, the annual growth rate across the combined capitals has eased back to just 2.2%”.

|

| 2 | “After Sydney home values fell by a staggering 2.2% in July—the biggest draw-down since 1983—the losses accelerated in August…with the final monthly decline coming in at an incredible 2.3%”.

| …”[T]he national index recorded the largest month-on-month decline since 1983…Sydney continued to lead the downswing, with values falling -by 2.3% over the month”… |

| 3 | “Sydney dwelling values are currently shrinking at a 19.7% annualised pace based on the last quarter of daily house price data (annualising quarterly data is quite common amongst central banks and statistical agencies)…[R]olling quarterly data…shows that the rate of losses in Sydney…continues to accelerate”. | “Values across Sydney (-2.5%) are now below the level recorded this time last year…With labour markets so tight…and some momentum gathering in income growth, we are not likely to see a material increase in the number of distressed listings or forced sales, despite the higher interest rate environment…The risk of housing stress is further minimised by serviceability buffers applied to borrowers as part of the loan approval assessment. The recent upswing is an important context in the current downturn. Although housing values are on track to record a significant drop, the risk of widespread negative equity remains low, considering the substantial rise in housing values between September 2020 and April 2022”. |

The contradiction in Item 1 above is self-evident.

Item 2 warrants close attention. By the expression “the biggest drawdown since 1983” the article not only substituted the national decline for the decline in Sydney, it also contradicted Mr Joye’s 31 July 2022 Newsletter which said: “[i]n Sydney, dwelling values declined by a staggering 2.2% in [July 2022] alone, which was the single biggest monthly loss since January 1990”…(emphasis ours).

“Staggering” and “incredible” are relative concepts. Relative to what? The article does not say.

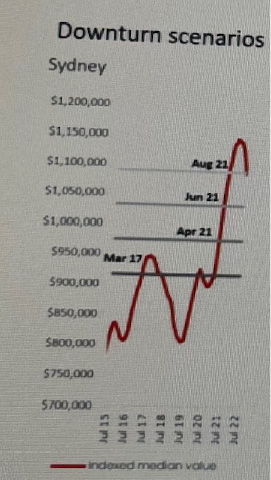

Looking at this graph for Sydney as presented by CoreLogic’s Dr Eliza Owen, at API’s 57th Kiparra Day on 19 August 2022, compared to the sharp fall between August 2017 and July 2019 and the sharp rise in housing values between July 2021 and the interest rate rises in 2022, the percentages referred to in the article are hardly “staggering” or “incredible”.

Source: CoreLogic

As to Item 3, whether or not “annualising quarterly data is quite common amongst central banks and statistical agencies” is an irrelevance; essential to the article’s entire thesis and inserted in the article to justify the conclusion that “Sydney dwelling values are currently shrinking at a 19.7% annualised pace” when the Index itself established the opposite; namely that “Values across Sydney (-2.5%) are now below the level recorded this time last year…[with] the risk of widespread negative equity remain[ing] low.”

As the next table shows, the AFR’s Chanticleer couldn’t resist the same bearish temptations:

| AFR’s Chanticleer 1 September 2022 | CoreLogic National Home Value 1 September 2022 |

| “CoreLogic data released on Thursday confirmed what various commentators [specifically referencing Christopher Joye] have been saying for weeks: Australian house prices are falling at the fastest pace in 40 years…Sydney is bearing the brunt of this fall, with prices now down 6.7 per cent in just three months”.

| “The annual trend in housing values is rapidly levelling out. After moving through a peak annual growth rate of 21.3% in November last year, the annual growth rate across the combined capitals has eased back to just 2.2%. Values across Sydney (-2.5%) are now below the level recorded this time last year”… |

Nor, it seems, is the temptation to reproduce comments out of context:

| AFR’s Chanticleer 1 September 2022 | ABC News 9 August 2022 |

| “As Commonwealth Bank chief economist Gareth Aird says: “That can only be described as a collapse in prices.”

| “Mr Aird bases [his view that economic data will soon give the RBA] “reasons to stop raising rates” in large part on CBA’s own in-house economic data, drawn from the millions of customers who bank with Australia’s largest financial institution…CBA’s forecast is for a major property market correction that risks turning into what market traders would generally define as a crash — where prices fall at least 20 per cent from their peak. “We’re looking for around about 15 per cent peak to trough — that’s conditional on the cash rate getting to 2.6 per cent,” he said. “If the RBA was to take the cash rate higher than that then we’d be forecasting a bigger fall in home prices.” However, Mr Aird does not think that is likely”. |

The above was not the only failure to put the Index in its proper context as these two further and self-explanatory slides from Kiparra Day show:

And if all that wasn’t enough to show the hyperbole:

- Much to the chagrin no doubt of the bears, despite four interest rate rises by 31 August 2022, according to SQM Research, Sydney’s:– August’s weekly auction clearance rates held steady:

| Week ending | Clearance rate % |

| 7/8 | 42 |

| 14/8 | 41 |

| 21/8 | 42 |

| 28/8 | 40 |

- Compared to July 2022, Sydney’s property listings fell 4.6% suggesting, and consistent with the Index, little vendor stress.

- On 29 August 2022, a Domain article entitled “RIP underquoting: In 2022, houses are actually selling for what they’re asking – or less” cited industry sources who, based on anecdotes, pronounced that “underquoting has all but disappeared since the property market changed “ and that “price guides have “certainly” become more accurate since the property market cooled off”.

The Domain article continued that this explained why “[i]n the 2020-21 financial year, Fair Trading received 200 complaints in relation to underquoting, while 133 complaints were received in the 2021-22 financial year.”

(In what follows, any price paid which is higher than the price guide by more than the statutorily permissible 10% is regarded as a prima facie underquote).

As this didn’t exactly square with our experience at the coal face in August 2022, we tested those opinions against on-the-ground data gathered by the inner west agency Adrian Williams researchers (as we did for our July 2022 Newsletter ).

The relevant results are summarised in this table:

| Week ending | Number of properties sold with a price guide | Number of properties sold for a price < the price guide | Number of properties sold for a price = to the price guide | Number of properties sold for a price < 10% above the price guide | Number of properties sold for a price > 10% above the price guide (prima facie underquote) |

| 6/8 | 6 | 1 | 0 | 1 | 4 |

| 13/8 | 8 | 0 | 0 | 4 | 4 |

| 20/8 | 4 | 0 | 0 | 1 | 3 |

| 27/8 | 13 | 3 | 1 | 3 | 6 |

| TOTALS | 31 | 4 | 1 | 9 | 17 |

| % of properties sold with a price guide | 100 | 13 | 3 | 29 | 55 |

Sure, it’s a small sample confined to 25 suburbs in one Sydney region, but it’s also empirically verifiable with there being no reason why it should not be regarded as representative of August 2002 auction outcomes Sydney-wide.

As to the annual drop in NSW Fair Trading complaints, it is obvious from the data reproduced in the Domain article that the drop began in March 2022 and was almost certainly caused not by reduced underquoting per se but by a profound slowing in the market just before and during the interest rate rises which caused an overall reduction in the number of conducted auctions.

Fewer auctions. Fewer complaints.

From this it seems only a small proportion of properties in fact sold for or less than their price guide (16%); most sold above their price guide (84%) and many were sold after a prima facie underquote (55%).

Drilling down further into the 17 prima facie underquotes:

- of the 10 highest, the mean percentage above the price guide was 23% and the median was 25% which, compared to the 10% statutory benchmark, is ‘staggering’

- the practice was not confined to one or two selling agencies but was spread over 11 separate agencies.

Far from resting in peace, it seems that even in a down-turning Sydney macro property market, underquoting is still very much alive, kicking and widespread.

To finish:

The last words for the bears belong not to the late Leonard Cohen but to Jarod Kintz: “When it seems like the sky is about to collapse, relax, that’s just the roof caving in.”