October 2022. One of the wildest rides on record for Sydney residential and commercial property thanks to the RBA. Our view from the coal face.

November 4th, 2022

To all buyers of Sydney residential and commercial property, you’d be forgiven if your heads were spinning.

This screen shot from the 26 October 2022 SMH captures the mood: as some were doubling their money in Sydney’s property market, others were fleeing with double digit losses.

This newsletter tries to make some sense of it.

Off to a good start

October 2022 began with nearly unanimous commentary, except for a handful of contrarians like us, that another 0.5% cash rate rise on 5 October 2022 was inevitable.

That commentary proved to be as unreliable as the month’s rainfall forecasts with the actual 0.25% rise immediately putting a spring (no pun intended) in the step of some buyers and sellers.

Adjusting to the new normal, residential and commercial buyer inquiry in the debt reliant $1.5 – $4 million bracket picked up slightly before falling later in the month as did auction clearance rates (for what they are worth) and listings of usually lower quality stock.

The prevailing animal spirit amongst our actual and prospective buyer cohorts quickly became a cautious optimism that the worst could be behind them.

Thanks to unprecedented low unemployment and now dwindling savings buffers squirreled away during lockdowns (as enthusiastically as the SMH says elected representatives have been squirreling away real estate), vendor stress was almost non existent.

As a result and given an inflation driven, interest rate rising environment, turnover remained historically low especially for this time of the year.

Meantime, the ‘less or no debt funded’ top end above $4 million began and continued the month unfazed with record results achieved on and off market. So-called price guides were smashed for numerous properties with development upside as well as prestigious penthouses and homes.

However and as reflected by the army of selling agents who twiddled thumbs updating their buyer databases, turnover at these levels was low by historical standards.

In the Sydney commercial property space, while the volume of deals plummeted and yields even loosened in the industrial space with more predicted at least for secondary quality assets, big players such as Singapore’s huge sovereign wealth fund, GIC affirmed their confidence in Sydney’s logistics and healthcare assets.

Undeterred by incessant WFH commentary (more on that later), GIC and other heavyweights such as the historically successful Charter Hall, announced plans to plough billions into premium grade Sydney CBD office and retail assets.

Demand for Sydney CBD strata offices was also strong.

In a similar vein, research from CBRE identified Sydney as a commercial real estate safe haven given the challenges facing Hong Kong and the physical capacity constraints in Singapore.

A glass half empty or half full?

You’d have to say ‘half full’.

While October 2022 was a month unlike any other, even these events failed to dampen buyers’ generally resilient animal spirits:

- The wettest month in Sydney on record

- Catastrophic flooding in eastern Australia pushing up grocery prices and highlighting the risks to property from climate change

- The threat of a global recession led by the US

- The brutal Ukrainian war causing soaring energy costs which continue to feed directly into the costs of domestic energy and construction

- Downgraded Australian economic growth forecasts

- Unrelenting sensational headlines such as “Median house price falls at its fastest rate on record” which irresponsibly ignored nuanced accompanying discussion such as this from Tim Lawless in the 1 November 2022 CoreLogic Home Value Index:

“The pace of falls has eased over the past two months across Sydney (-1.3%)…To date, the housing downturn has remained orderly, at least in the context of the significant upswing in values. This is supported by a below-average flow of new listings that is keeping overall inventory levels contained. There’s also tight labour market conditions, an accrual of borrower savings and a larger than normal cohort of fixed interest rate borrowers, who have so far been insulated from the rapid rise in interest rates.”

- Wildly conflicting property data and trend commentary. Here are just two examples:

(1) A popular YouTube clip on 24 October 2022 in a series of such clips by Digital Finance Analytics (DFA) entitled “Operation Antispruik In Sydney’s Inner West (IW)” with the tag line “[m]ore evidence of price falls, and big ones at that.”

As this was one of only two such clips so far covering greater Sydney (the other being the northern beaches) and coincided with the region covered by agents, Adrian William (AW) whose data gathering efforts are referenced in our popular A deep dive into Sydney’s auction clearance rates, we thought it would it would be useful to compare DFA’s dire price drop “12 month Base Case” predictions based on reduced price guides DFA identified (all being poor quality properties apart from one ‘renovator’s delight’ which, because of soaring building costs as well as tight materials and labour supply, are generally unpopular at present) with actual results observed and recorded by AW’s team of researchers.

At the risk of being accused of spruiking – which we don’t – the contrast based on an analysis of AW’s objective evidence, couldn’t be more stark:

| Number of IW suburbs | Number of IW suburbs covered by DFA | Number of IW suburbs covered by AW | Cross over suburbs between DFA and AW | DFA average forecast Base Case 12 month price drops based on reduced price guides in cross over suburbs % | AW average by which sales prices on 29 October 2022 exceeded initial price guides (IPG) in cross over suburbs % |

| 53

| 9 | 25 | Glebe, Leichhardt, Marrickville | -13% | +20 |

Reinforcing obvious conclusions from the above, are these AW statistics gathered over 17 sales.

| Sales price relative to IPG % | Number of properties |

| >30 | 1 |

| 20-29 | 5 |

| 15-19 | 1 |

| 10-14 | 3 |

| 5-9 | 5 |

| 0-4 | 1 |

| <0 | 1 |

Yes, DFA, based on a sample nearly three times larger than yours and covering almost half the entire population of relevant suburbs, only one IW property sold below its IPG last weekend and it too was poor quality.

Also impossible to reconcile with the dire scenarios painted by the bearish DFA’s of this world was opposite commentary like this in the 31 October 2022 edition of API’s Australian Property Journal:

“Most Australian mortgage holders should be able to ride the wave of interest rate hikes, with prime mortgage arrears coming from a strong position ahead of steep monetary policy tightening.

According to S&P Global Ratings’ latest RMBS Performance Watch: Australia, the majority of borrowers should be set up to endure a moderate level of ongoing interest rate rises, thanks to relatively modest loan-to-value ratios and higher seasoning of loans.

These conditions should allow mortgage holders greater options for self-managing their way out of any potential financial stress, as well as dodging entering arrears. Particularly as competitive refinancing conditions result in a broader range of options”.

Similarly, having conducted a postcode by postcode deep dive into its loan book, the ANZ found that only a relatively small number of its customers might fall into hardship as home prices fall.

(2) The ongoing hybrid/work from home saga: on the one hand, countless surveys and articles this month pointed to Sydney’s CBD having changed permanently with implications for the CBD, inner city property markets and house designs.

On the other hand, there are weighty contrary indications including IT behemoth Atlassian which champions in one breath working from anywhere while in the next, is about to build the world’s tallest hybrid timber 39 storey office HQ in the new Central Station tech hub.

Further, as the AFR reported on 18 October 2022, “[d]ata from CBA/Regional Australia Institute showed regional residents have resumed their migration back to the capital cities, with net migration to regional areas dropping by 35 per cent since the March quarter.

[According to SQM’s Louis Christopher] “Fewer people are moving into the regions and there’s now a higher flow of population back to the capital cities, that’s why we’re seeing a large portion of stale listings that have been sitting on the market for more than three months””

As reported in The Australian on 13 October 2023:

“The nation’s chief executives are preparing for a global recession next year, planning for hiring freezes and lay-offs, according to a survey conducted by KPMG.

The professional services firm’s latest chief executive outlook shows 78 per cent of CEOs surveyed were preparing for a downturn by planning or implementing a hiring freeze.

Most – 64 per cent – were also considering lay-offs.

KPMG Australia chief executive Andrew Yates said the survey was the first time in the past eight years that CEOs had been expecting a downturn.

He said the survey had shown there was now an expectation among business leaders in Australia that there would be “short, mild recession” over the next year. “There is quite a different sentiment in this year’s survey with a downturn being anticipated,” he said.

He said confidence had been hit by the pandemic, rising inflation and the Russian invasion of Ukraine”.

In our view, the hybrid model is here to stay for those enterprises it suits. For others, such as law, where mentoring is essential, back to the office will soon again be the norm thanks to engineering by the RBA and Federal Labour government which will see skilled unemployment rise at the same time as nearly 200,000 foreign workers flood the market in 2023.

- Long promised and misconceived State legislation to overhaul stamp duty as now introduced to the lower house by what’s left of the Perrottet government before and as many predict, this reform fails to pass the upper house and the rump of that government loses the 25 March 2023 election

- The Federal Budget on 25 October. Federal budgets typically cause property markets to pause while digesting the implications. This one however, was overwhelmed the next day by official confirmation that Australia’s inflation rate had hit a 32 year high 7.3% and later, by its failure to deal with skyrocketing energy bills

- Saving the most important (as the heading of this edition suggests) to last: a complete loss of confidence in the RBA.

And with good reason.

The RBA, whose interest rate decisions so profoundly affect all Australian residential and commercial property micro markets, this month confirmed our view (as we have published for three years) and many others including our actual and potential buyer cohort, that it is out of touch and control.

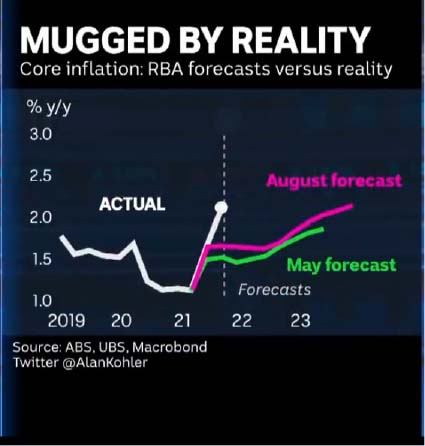

Coolabah’s Christopher Joye nailed it this time in excoriating articles on Livewire followed by another in the AFR entitled “Blind Freddy could have been the RBA’s property predictions” on 28 October 2022 which is worth reading in full and contains these extracts:

“The inflation data is also three to four months old and will be quickly superseded by a preponderance of data pointing towards recessions in many developed economies. This will eventually feed back into weaker inflation and implies that the peak in interest rates is in sight after one of the most aggressive tightening cycles in history juxtaposed against the most indebted households we have ever seen.

Last Friday, the RBA was forced to publish a truly extraordinary 105-page treasure trove of freedom of information (FoI) disclosures regarding its house price forecasts. This furnished many important insights.

The first was that when the central bank started tightening policy in May, it did so assuming that the enormous circa 2.5 percentage points of interest rate increases…would have little impact on house prices.

It specifically forecast quarterly house price changes only very slightly below zero per cent over 2023. This was a remarkable leap of faith given that the 1.4 percentage points of interest rate cuts between June 2019 and November 2020 were a key contributor to the subsequent 37 percentage point increase in Australian house prices.

Blind Freddy could have figured out that changing the single biggest driver of household purchasing power (mortgage rates) would have a material impact on the price of properties…

In a presentation discussing the downgraded forecasts, the RBA states that in “real [inflation-adjusted] terms, prices are forecast to decline by almost 20 per cent”…

This huge shift in the RBA’s outlook from assuming little change in house prices to the biggest losses on record could have significant consequences for its expectations for consumption, building, demand, growth and ultimately the appropriate path of monetary policy.

We would argue that the RBA has consistently got housing market movements wildly wrong since 2013, when it failed to anticipate the huge housing boom that emerged following aggressive interest rate cuts. It also failed to predict the record house price correction between 2017 and 2019 in response to higher mortgage rates resulting from the Australian Prudential Regulation Authority’s application of its macroprudential policies.

It further missed the 10 per cent boom between 2019 and 2020 as rates were cut, the tiny 2 per cent dip between March and September 2020, the subsequent 20-30 per cent boom in response to both monetary and fiscal stimulus, and now the record correction that commenced in May 2022 in response to its record interest rate increases”.

A half empty glass from here?

Nobody knows.

Even leaving aside the unknown unknowns, the present array of known knowns and known unknowns makes any predictions more of a mugs game than usual.

What we can say is that price reductions are now occurring in all Sydney regions even for some quality properties in and above the $4 million bracket in the lead up to Christmas.

While this time of the year always provides an impetus to get deals done whether because of relationship breakdown (much more prevalent post COVID) or otherwise, the next six weeks could prove to be a perfect buying window before the independent review’s March 2023 report into the RBA leads to some overdue and major changes.

For us, that can’t come soon enough!