Sydney’s property market Q2 2016 – All this uncertainty deals buyers the winning hand

August 4th, 2016

Although not widely appreciated, the June 2016 quarter was one of the most uncertain three months for property investment in Sydney since the global financial crisis which began in September 2008.

The winds came from every direction; literally on 5 June when, in a reminder of the risks posed by rising sea levels, huge storms lashed Sydney’s coastline eventually leading to the loss of lives and around 15 houses.

The dominant influence of course and the one which created the back drop against which everything else happened, was the much anticipated Federal election campaign as eventually called on 8 May. It lasted 54 of the 91 days in the quarter.

This particular election was a greater source of uncertainty to Sydney property investors than usual because the Labor Opposition campaigned on the promise that if elected, it would restrict negative gearing to new built housing and reducing the tax discount for capital gains – a policy that represented the first serious challenge in over 30 years to one of the property market’s most sacred of cows.

Prime Minister Turnbull’s false claim on 16 May that the “value of property will come down” if Labor got its way achieved a further de stabilising torrent of words in the property commentariat during the rest of the quarter. That included an episode of Four Corners on 2 May – “Home Truths” – which was devoted almost entirely to the topic.

Elsewhere in Sydney, real estate was either in or close to the eye of several other storms metaphorical rather than meteorological.

One after the other they rolled in with the biggest respite being the Federal Budget which had little effect. The same can be said of the shock Brexit result on 23 June which saw a falling British Pound clip the wings of expatriate buyers repatriating funds to Australia.

Here is how some of it happened:

- 14 April: RBA published its semi annual Financial Stability Review. While noting reduced investor activity as a result of tighter lending conditions, reduced demand from Chinese buyers and softening prices, that Review also commented for the first time on an ongoing risk from significant and geographically concentrated growth in the supply of new apartments in Sydney. A topic on which we took an early lead in our 14 April 2016 CurtiseCall, the risk of oversupply became a hot item this quarter with many including the OECD, Core Logic RP Data and Meriton’s usually reclusive Harry Triguboff sounding dire warnings of one type or another

- 15 April: The recently floated property group McGrath Ltd shares were placed in a trading halt as a result of disappointing listings and commission revenue from the north and north western regions of Sydney said to be caused in part by an exodus of Chinese buyers. A lift to the halt saw further falls with the shares eventually settling at about 31% of their December 2015 IPO price which justifiably led many to ask: ‘Did John McGrath sell out because the Sydney property bubble is about to burst ?’

- 18 April: APM auction results published the lowest auction clearance rate for 2016 at 67.7% – a figure which even left Domain’s usually ebullient Dr Andrew Wilson sounding downbeat

- During April : Reflecting APRA’s consistently tight lending controls to achieve sub 10% credit growth, CBA refused to accept finance applications from self employed foreign income sources

- 27 April: Westpac and all its subsidiaries stopped home lending to non residents and temporary visa holders

- 3 May : The official cash rate was cut to 1.75% as a result of deflationary pressures and stagnant wage growth

- 9 May: A variety of non bank lenders stopped lending to foreign borrowers

- 12 May : The NSW State Government announced the amalgamation and proposed amalgamation of 24 local Sydney Councils into 12 with unknown implications for future urban planning and development. This, together with the running sores of Westconnex and the Sydney lock out laws, became one of many grievances over which about 4,000 people protested and marched to State Parliament House on 30 May

- 24 May: Reserve Bank Governor Glenn Stevens warned “the assumption that there’s an easy road to riches through leveraged holdings of real estate . . . is not a great strategy”

- 8 June: ABS confirmed that new housing finance fell month on month by 1.8% in April 2016 led by a 5% fall in loans to investors between March 2016 and April 2016

- 9 June: Another warning from Governor Stevens; this time that Sydney’s property price boom is “acutely concerning…I think some of what’s happening is crazy”…

- 21 June: The NSW State Government budget imposed on foreign property buyers an immediate 4% stamp duty surcharge and from 1 January 2017, an extra 0.75% land tax.

During all of this, mainstream media seldom missed a chance to talk up the Sydney property market with commentary that now does not withstand scrutiny.

Other research houses caught the same bug: for example, on 2 May Core Logic RP Data published its Hedonic Home Value Index showing Sydney dwelling values rose over the March 2016 quarter by a bullish 3.9% – a result which surprised many economists and several others including us because it appeared to be wrong. Looks like it was: whether because of some hidden methodology or otherwise, that result bore no resemblance to the Residential Property Price Indexes published by the Australian Bureau of Statistics (Catalogue 6416) seven weeks later on 21 June which confirmed Sydney dwelling values actually fell 0.7% between the Dec 2015 and March 2016 quarters.

Other commentary used selectivity to understate the true extent by which Sydney’s auction clearance rates were being propped up via low turnover on both the selling and the buying sides. (If it was just on the selling side and buyer demand remained at the same levels as last year, auction clearance rates would have skyrocketed which they did not).

For example, while the published APM auction results for each Saturday in the 13 week June 2016 quarter conveyed a prima facie healthy 74%, nowhere was it mentioned that in the June 2016 quarter relative to the same quarter last year there had been:

- a 25% reduction in auction turnover ($3,823,951,453 down from $5,091,865,982) and

- a massive 28% reduction in the number of properties actually sold at auction (3,822 down from 5,286)

Even these percentages understated the extent of the auction downturn when it is realised that in 2015, unlike 2016, two of the 13 weeks straddled Easter Saturday and ANZAC Saturday during which a total of just 84 properties were listed for auction with only 49 of those selling on the day.

Similarly, while Dr Wilson may have been right to say the “Sydney Market soar[ed]” on 14 May 2016 as investors staged a come back ahead of possible changes to negative gearing, a more nuanced summary should have added that Saturday auction listings, sales and turnover in the June 2016 quarter were significantly below the June 2015 quarter on every one of the 13 Saturdays except for 4 June 2016.

Looking only at these auction figures, one would think, wrongly, that the Sydney property market is on the verge of collapsing or at least seizing.

Adding to that impression is the chorus of complaints from selling agents about housing stock being in unprecedented short supply as mentioned in our last article. Loud in the March 2016 quarter, that chorus became almost deafening this quarter.

We now wonder if it is right or not: listings data published by Core Logic RP Data shows for example that in the four weeks to 29 May 2016, whilst new listings were down 5.8%, total listings (both new and old) were up 25.8% over the year.

SQM Research also reported that Sydney property listings were up 30.9% in June 2016 relative to June 2015.

Doesn’t sound too much like under supply to us nor has it been the experience of Curtis Associates at the coal face this quarter where the problem has not been finding stock but finding quality stock which is always the case in every property cycle and which usually commands some amount of trend bucking premium.

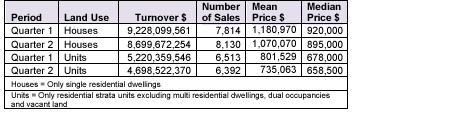

Our analysis of raw turnover figures for all Sydney Local Government Areas in the June 2016 quarter relative to the March 2016 quarter similarly does not harmonise with that chorus. The following Table is also based on data from Core Logic RP Data which we hope got it right this time:

Summarising: in the June 2016 quarter relative to the March 2016 quarter:

- the number of houses traded actually increased by a statistically significant 5%

- the number of units traded decreased by a statistically insignificant 2%

- both mean and median prices of both houses and units fell which further suggests that the March 2016 quarter downwards trend confirmed by the ABS on 21 June continued in the June 2016 quarter.

There is also another and powerful new trend which has escaped commentary so far and may mean that the increase in listings identified by Core Logic RP Data and SQM Research actually understate the true levels of available Sydney housing stock.

Here we are referring to the rapid rise in the number of properties for sale “off market”. In this context, these are properties offered by selling agents only to select databases of buyers without being advertised to the open market. As such, they may not be included in the ‘listings’ reported by those two research houses.

Sellers do it mainly because they believe they will achieve a price above market.

Buyers do it mainly because they believe they will achieve a price below market.

In a trend that began in the last half of 2015, especially in the eastern suburbs, “off market” properties have become the new black for many selling agents.

In the June 2016 quarter alone, Curtis Associates received over 400 such notifications from selling agents all over Sydney – that is an average of more that 30 properties per week in the quarter just gone.

One prominent eastern suburbs agent has just included as one of four marketing headlines, the claim that 41% of all sales so far this year have been “off market”.

Another and even larger agency recently sent a flier with this opening sentence:

“Do many off market sales take place? You bet they do! …Last year we transacted 433 sales with almost 110 being off market. So far this year, 50 of our 224 sales have been off market”.

Perhaps the choir of selling agents complaining about a lack of stock are now singing from the wrong song sheet and should change their tune from one being about auctions to one being about selling “off market”.

Conclusion:

It appears that buyers of Sydney residential property in the June 2016 quarter reacted to the storms of uncertainty and actually gained the upper hand in part, by sensibly steering clear of auctions (which we have been advocating for years) and by driving harder private treaty bargains both on and “off market”.