The Sydney residential property market over $1.5 million in May 2012. Let’s dance!

May 31st, 2012

Following the popularity of our CurtiseCall April 2012, this month we present a similar analysis to last but with a twist – no pun intended. Instead of comparing May 2012 with May 2011, here we compare house sales over $1.5 million in May 2012 to April 2012.

To continue the theme of last month’s article, whereas buyers last month stood around the dance floor, this month the party for houses over $1.5 million really started with, as you will see below, some interesting trends buried in the statistics.

Why this spike in activity given the confidence sapping effects this month of:

- a faltering US economic recovery

- the French Presidential elections

- the unresolved political crisis in Greece

- rising bond yields in Spain and

- the abolition in the Federal budget of the 50% capital gains tax discount for non-residents in respect of capital gains accrued after 7:30pm (AEST) on 8 May 2012?

The answer almost certainly has to do with the 50 basis point cut in official interest rates on 1 May 2012 which was the largest such reduction since the height of the global financial crisis. For some buyers, it was not only the figure to which the official cash rate was reduced this month that renewed their appetite for debt, but also the strong signal which it sent that an era of low interest rates might have dawned. The latter observation further suggests that persistently low interest rates may, at some point, operate to alleviate buyer concerns about the global economy and Europe in particular.

The more buoyant mood also influenced some of those in the pool of cashed up buyers with at least two of the largest purchases this month totalling nearly $12 million requiring either minimal or no financing.

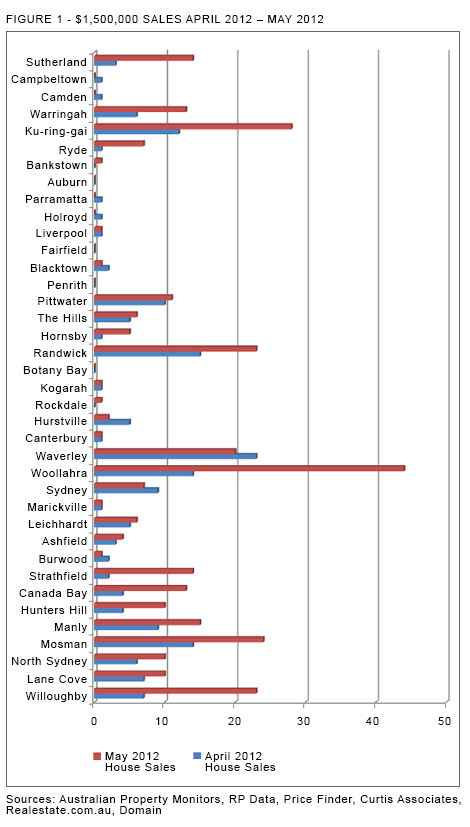

The results for all reported house sales over $1.5 million in every Sydney Local Government Area (LGA) are presented graphically in Figure 1.

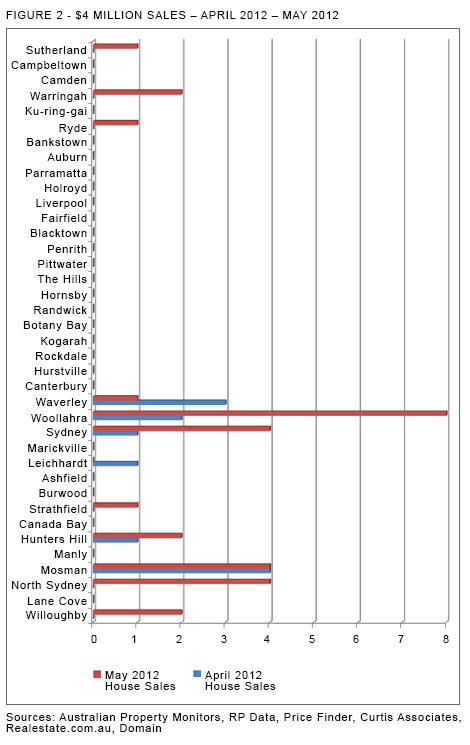

Figure 2 shows the sub – set of houses over $4 million in every Sydney LGA.

Summarising:

- For sales of houses in the Sydney property market over $1.5 million, volumes this month were up 77% on the previous month.

- Over $4 million, sales volumes this month relative to last doubled to 24.

- Increases in volumes were recorded in all but eight of the 38 Sydney LGA’s.

- The four largest increases between each month occurred in the middle and outer ring suburbs of Strathfield, Ryde, Hornsby and Sutherland.

- In what may be proof of its only being a matter of time before the trends evident in Mosman as discussed in CurtiseCall March 2012 emerged in Woollahra, the dance floor in the latter LGA this month erupted into life with the 44 recorded house sales over $1.5 million easily beating Ku-ring-gai in second place with 28 such sales. Of those 44 sales, 15 were of homes having a Paddington address.

- Mosman consolidated its position for homes over $4 million recording four sales in this bracket in each of this and last month.