The Sydney winter property market over $1 million. Keeping the brakes on.

August 4th, 2013

With reports of 80% plus auction clearance rates for seven consecutive weeks and falling interest rates, revenue starved mainstream media has this month had a field day talking up Sydney’s property market to levels not seen since the pre GFC boom days of late 2007.

But drill down and the mood around many parts of the $1 million plus market this month was quite different to that of 2007 in one important respect: unlike the credit fuelled excesses of 2007 which saw price records being broken daily, this time around and as the evidence we have assembled below shows, demand was shallow and patchy and instead of lending rising to record levels, the nation’s ratio of savings to income, this month continued to rise.

Price increases above $1 million for properties bought and sold within the past seven years were often modest and in many instances, anaemic. And that is with no allowances being made for stamp duty, other transfer and holding costs, development approval fees or actual renovation costs where applicable.

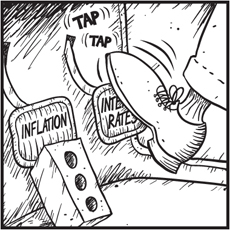

Whilst the downward trajectory of interest rates encouraged buyer confidence, a justifiable concern as to what that trajectory revealed about the underlying state of the economy acted as brake on that confidence.

Rather than signalling the return of boom times, the rising auction clearance rates this month were more a function of short supply at all price levels and especially supply of decent quality stock. Such inertia this month was partly because of the stultifying effects on would be vendors of the pending Federal election, (which is usual) and partly because of a concern about the state of the economy generally and rising unemployment in particular which saw erstwhile vendors opt for the ‘make no sudden moves’ alternative.

The tables below present a Sydney wide sample of purchases this month of houses and apartments over $ 1 million which were purchased within the past seven years.

In addition to separating houses from apartments, those tables separately present those properties:

- to which no or no substantial improvements had been carried out in the past seven years

- which had been improved in the past seven years and

- where development consent for improvements had been granted without the improvements having been carried out.

From the samples accessible by clicking that link, some trends in this bracket are clear:

- Unrenovated properties outperformed the inflation rate but only just when allowance is made for stamp duty and other costs

- Renovating houses was more than twice as profitable as renovating units

- Actually undertaking renovations did not materially improve the monetary return on investment.

- Whilst it is impossible to ascertain the actual costs of each renovated house and apartment mentioned above, the single digit 9.08% average price increase achieved for renovated houses and 4.14% for units suggests that in all but exceptional cases, the renovations were hardly worth the effort, stress or expense.

- 48 Lyne Street, Alexandria was one such exceptional case which, in a repeat of the premium it commanded when it sold unrenovated on 16 November 2010 for $925,000, sold in its exquisitely renovated form at auction on 24 August 2013 for a suburb breaking $1.825 million.

- What was exceptional about it?

- North to the rear on a very wide and large block for that suburb (around 6m and 200m2 respectively) with rear lane access and parking for two small cars in one of six quiet Alexandria Streets allowing such a north to the rear aspect.

- Although just under the $1 million threshold, the story was similar at the auction of 83 Day Street, Leichhardt on 29 August 2013. North to the rear and also well renovated, four bidders within $4,000 of each other and well after the property was announced to have been on the market, pushed the price of that property to $979,000 which was $109,000 over its reserve.

- The highest profits were likely to have been achieved by those who converted a raw property to one with development consent without actually undertaking the renovations

- As discussed in CurtiseCall September 2011, timing as well as time in the market can dictate whether or not a capital gain is made on re sale.

- In a reminder of what can happen if the brakes are let off , the sampled properties bought in 2007 were those to record the worst capital growth rates whether being an unrenovated unit (29/5 Wulumay Close, Rozelle -1.59%); a renovated unit (15/26 Walton Crescent, Abbotsford – 6.79% excluding renovation costs) or with development consent but not built (1 Dillon Street, Paddington – 1.38%).

- Once adjusted for inflation, those sellers have certainly incurred significant losses over the past six to seven years.

In a contrasting tale which illustrates the gist of this month’s article, on 31 August 2013 when the rest of Sydney’s residential property market was on its way to a near all time record breaking 84% auction clearance rate, the strangely renovated 5 Mort Street , Surry Hills with its south to the rear orientation failed to attract one registered bidder.